Sejak Eddie took over Hextar Global pada May 2017:

- Harga Saham dah naik 311%

- Revenue 10x dari RM69m to RM618m

- Dari loss making to very profitable company

Macam mana dia buat? His strategy? One word – PACMAN.

Untuk appreciate strategi PACMAN beliau, jom throwback di mana Hextar sebelum Eddie Ong took over.

Sebelum 2017, Hextar dikenali sebagai Halex Holdings Berhad. Bisnes utama Halex adalah manufacture agrochem for crop management dan health disposable products.

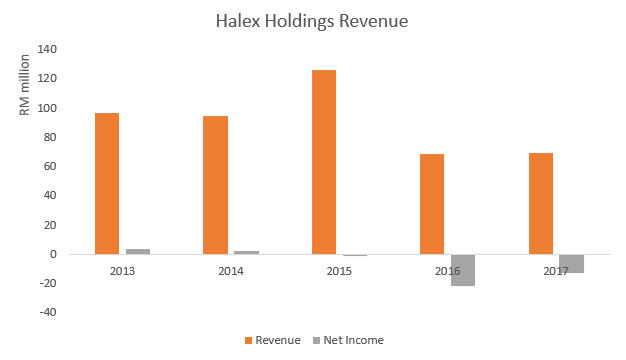

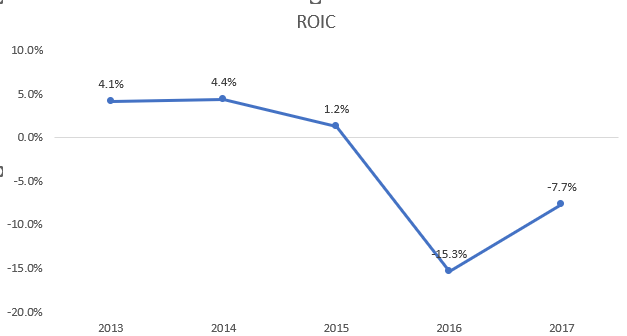

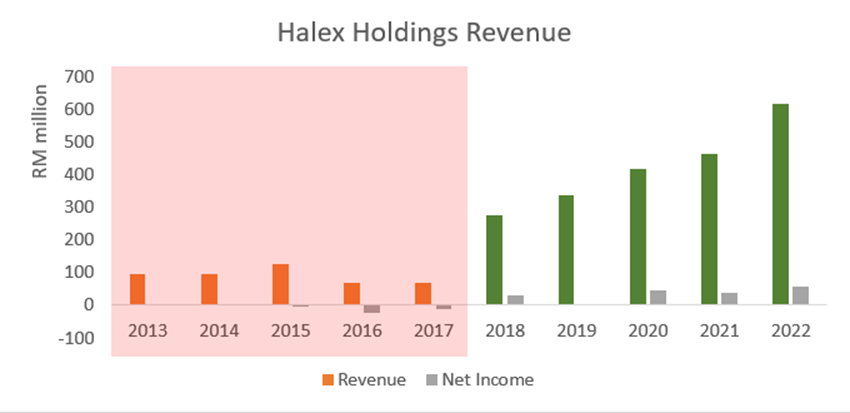

Sepanjang 2013 – 2017, performance Halex sangat sluggish.

- Revenue drop 30%

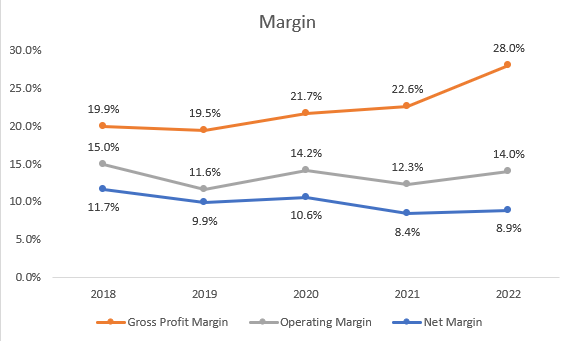

- Net margin low single-digit

- Dari razor thin profit to loss in 2015

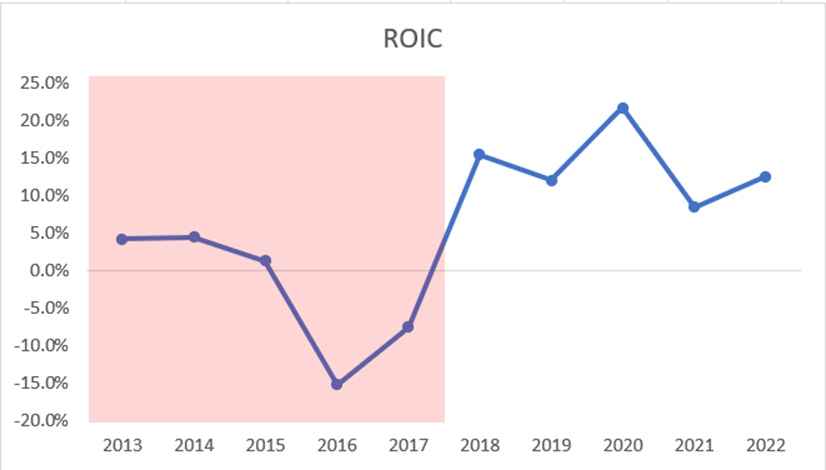

- Return on capital so low – value destructive to shareholders.

Tapi Eddie saw some opportunity in Halex that not many see…

Opportunity untuk fast track listing company private beliau, Hextar Chemicals Limited (HCL), dengan menelan public listed Halex. What makes this easier is HCL kongsi bisnes yang sama dengan Halex – Agrochem. At the same time dia akan increase market share dgn makan competitor.

Ini Pacman pertama. Dan dalam accounting, merger sebegini dipanggil reverse acquisition.

- Reduce listing cost

- Recognition by international customer

- Open more biz opportunity

Bermula dengan beliau menjadi majority shareholder dalam Halex in 2017 dan execute acquisition in 2018.

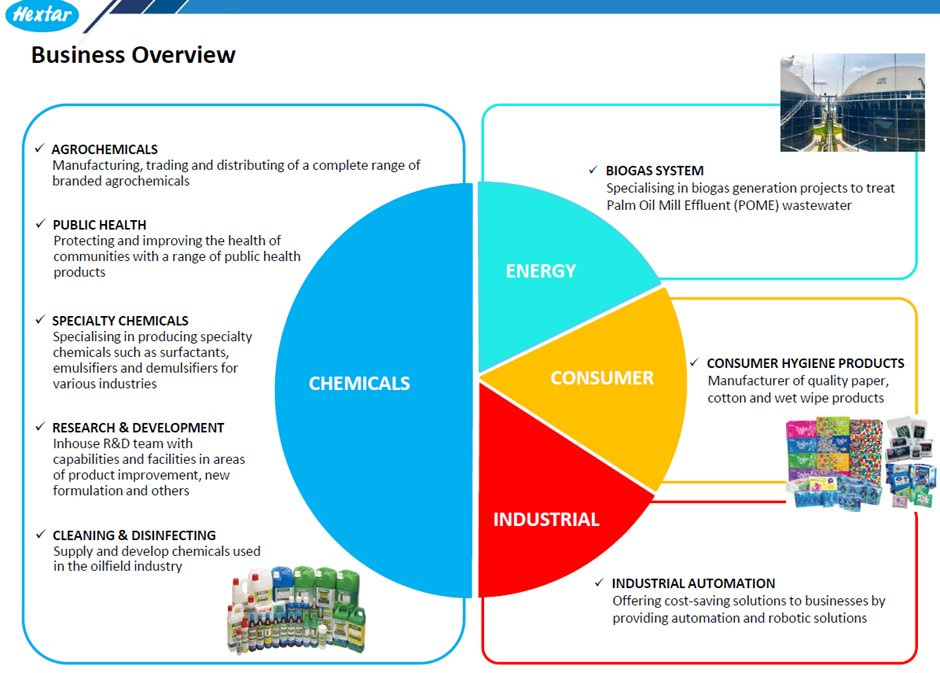

Maka terbentuklah Hextar Glolal in 2019. Eddie sebagai Managing Director. BOD member bertukar ramai-ramai. New business direction is set; buang unprofitable ventures & fokus pada core competency – Chemicals. Increase synergies between the two formerly different companies.

Dari 2019-2022, Eddie meneruskan strategi PACMAN dengan siri-siri acquisition yang synergistic.

- Acquire Biogas renewable energy plant

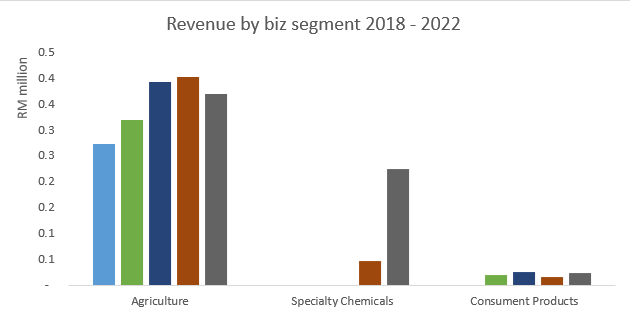

- Venture into specialty chemicals, acquire ENRA, NOBEL, etc.

- Set-up Agrotech division, use IOT and 5G tech

The goal is to become an AgroChem specialist.

Dan hasilnya, syarikat menjadi profitable kuasa 10. Hextar Global achieved record revenue with diversified chemical business and returning value with high ROIC. Thin single digit margin jadi double digit to high single digit. Contribution from specialty chemicals overtook the core AgroChem in terms of net profit.

Dan during this time, harga saham Hextar becomes 4 bagger, dalam masa sama mereka juga membayar dividen kepada shareholders. If you invested RM10k at the start of takeover, your investment is now worth at least RM41k after 5 years (excluding dividend). Midas Touch.

Now you may ask, kalaulah strategi PACMAN ni bagus sangat, kenapa company lain tak fokus untuk acquire dan merge dengan bisnes lain?

Sebab its so hard to get the right company to acquire. Banyak juga company PACMAN tapi acquire non-synergistics, high risk dan tak jadi apa2. Acquiring company jugak datang dgn banyak baggage2 yang perlu diselesaikan.

Bayangkan bila anda berkahwin dan duduk dengan pasangan, banyak rules2 baru dan kesefahaman yang kena ada untuk jadikan perkahwinan harmoni. Begitu juga dlm acquisition. Its difficult.

Tapi the fact that Hextar have managed to pull this off really shows their grit and painted positive notes on the quality of the management. Decision untuk fokus core competency also paid off. Ultimately, the rewards go to shareholder who trusted their money with the company.

So whats next for Hextar and Eddie Ong?

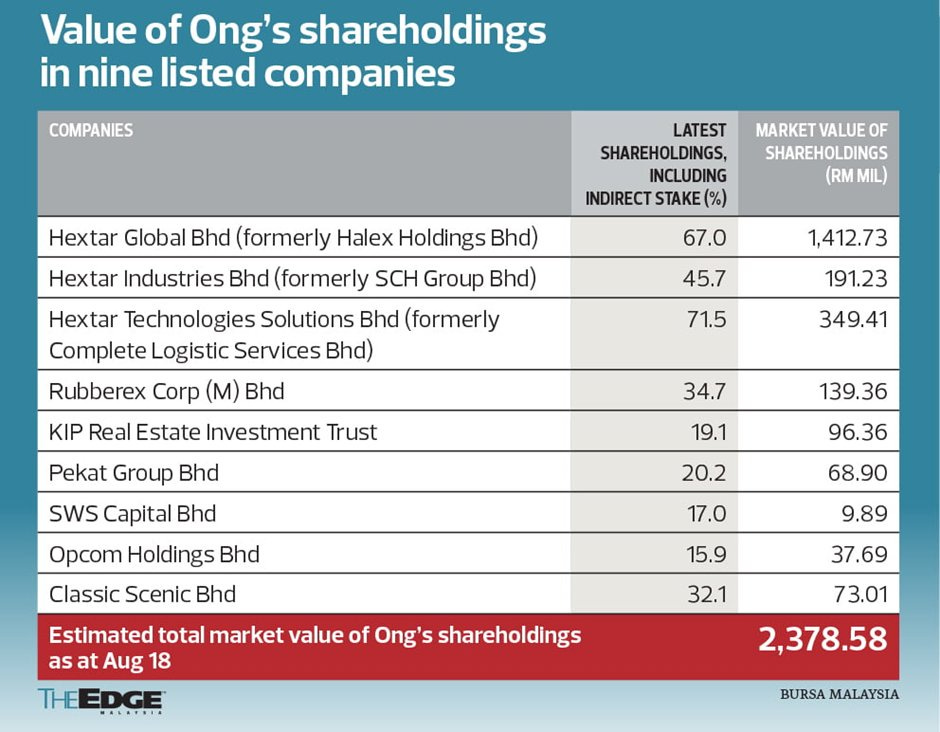

Eddie dah resigned from Hextar untuk pursue other interest tapi remain heavily invested in the company. Fokus baru beliau antaranya is Hextech. Nampak MO yang sama, dan market already reacted positively dengan kenaikan saham berganda2.

Untuk Hextar pula, mereka nak fokus usaha sinergikan acquisition yang telah dibuat sebelum ni. To grow the specialty chem business Dan terus acquire synergistic company. Terbaru, Hextar nak venture dalam Durian trading pula dengan acquire PHG Ever Fresh Fruit.

Questionable sikit acquisition kali ni, but only time will tell if they can pull it off again. Katanya, China adalah market besar untuk Durian dan banyak eksport dari Thailand. Mampukah Hextar pecah dominasi Thailand?

Story for another day.