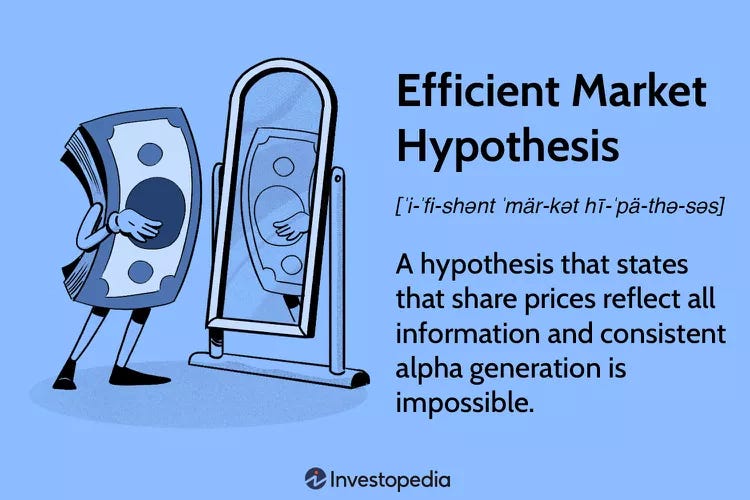

Pernah dengar Efficient Market Hypothesis (EMH)?

Hypothesis ni kata, anda tak akan boleh consistently jumpa undervalued or overvalued stocks, sebab every price is a reflection of all available information.

No information is gone unnoticed by the market. Hence every stock price is pretty much “fairly” valued.

Tapi betul ke?

Cuba perhati gambar di atas.

Duit di jalan tu sepatutnya tak dikutip sebab disitulah tempatnya yang paling effisien menurut segala informasi yang market participants ada.

Itulah EMH.

Basis kepada hypothesis ini adalah:

- Financial market is a competitive place

- Setiap orang nak maximise profit

Kalau ada pattern atau information yang boleh jana excess return dengan mudah, maka setiap rational market participants akan terus exploit dan price terus akan adjust accordingly.

Inefficiencies quickly diminished.

Kenapa EMH ini controversial?

Sebab penyokong tegar EMH kata both:

- Financial Analaysis

- Technical Analysis

tak boleh dipakai untuk generate alpha consistently dalam efficient market. Price always reflects fair value. You can only earn market return in long term, not more.

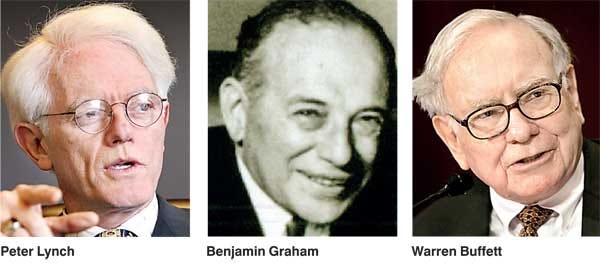

Walaupun ada yang berjaya generate alpha secara konsisten seperti Warren Buffett, Benjamin Graham dan Peter Lynch, mereka dikategorikan sebagai “small group of people who got lucky”.

Bukan sebab strategi mereka yang superior.

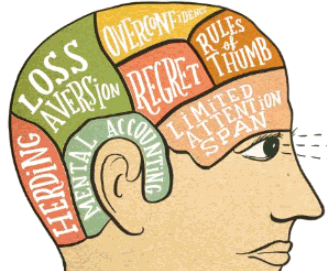

EMH ada cult yang luar biasa, tapi not until 40 years ago (1979) bila Behavioural Finance (BF) mula jadi mainstream. Behavioural Finance mengkaji sifat dan fitrah manusia dalam mengambil risiko; Dan kemaskini teori-teori finance berdasarkan kajian ini.

Antara assumption yang diguna pakai EMH dan di update oleh BF:

- Humans are not always rational.

- Humans are controlled by set of beliefs that may deviate from rationality, e.g. faith

- Information is valued differently by different person

- Humans deemphasise future info

Semua ni membawa kepada perlunya menyemak semula teori EMH berdasarkan input BF.

Masih ada ongoing argument walaupun lepas 40 tahun, tapi saya berpegang pada versi berikut:

Market is efficient for most part and most investors, but there are some parts and for some investors that the market is inefficient.

This implies:

- Inefficient – Boleh generate consistent alpha return.

- Efficient – Price eventually converge to fair value

Sebagai investor, untuk generate excess return, anda perlu tahu dimana dan bila market akan jadi inefficient. Sebab there lies the alpha you are looking for.

Good spots untuk cari market inefficiency includes:

- Dalam market yang illiquid.

- Dalam market yang opaque and limited information

- Dalam market yang belum discovered by smart money.

A caution.

High inefficiency tak bermaksud you will be able to make money from that. It means there is high potential that big misvalues happened there. Then it boils down to your skill, how do you take advantage of the inefficiency.

Sebagai penutup, ada satu perkara yang boleh bantu anda consistently generate alpha given the market inefficiency.

That is by being a little bit more rational than others.

Take advantage of the situation and overcome human nature and biases. Cuma satu disclaimer nak bagitahu.

It is very difficult to do so consistently.

Sebab tu orang kata the biggest enemy in investing is not the market.

But yourselves.